Consultation Hotline:

15800517267Your current location:Home Corp Cert & Docs Company Registration

Foreign Investment Options in China: WFOE, JV, and RO

Why Choose a Wholly Foreign-Owned Enterprise (WFOE)?

A Wholly Foreign-Owned Enterprise (WFOE) is a Chinese legal entity with 100% foreign investment. It offers foreign investors complete autonomy in business operations and enhanced intellectual property protection in accordance with international law. By providing full domestic retail and wholesale sales rights, WFOEs eliminate operational risks often associated with Chinese partners in many industries. As a result, WFOEs have become the most popular choice among international investors looking to enter the Chinese market.

WFOEs can engage in a wide range of activities, including sales, marketing, consulting, trading, warehousing, manufacturing, and delivery services. They also have the authority to issue invoices and sign commercial contracts.

Core Advantages of WFOEs

Diverse Business Scope: WFOEs can engage in various activities, including production, sales, import/export, and consulting services, providing extensive business opportunities.

Independent Operation: WFOEs have the autonomy to issue invoices and sign contracts, streamlining business operations and enhancing efficiency.

Flexible Employment Policies: There are no restrictions on the number of employees, allowing WFOEs to scale up or down according to business needs.

Transparent Financial Management: After tax payments, profits can be freely repatriated, ensuring financial transparency and flexibility.

What is a Representative Office (RO)?

A Representative Office (RO) is a liaison office established by a foreign company in China. As a non-independent legal entity, it serves as an extension of the parent company's business operations in China. ROs are one of the simplest forms of foreign investment, making them an ideal choice for companies in the initial stage of entering the Chinese market.

Representative Office (RO)Limitations

Restricted Business Scope: ROs are only permitted to conduct activities such as market research, product promotion, and quality control.

Prohibition of Commercial Activities: ROs are not allowed to sign contracts, issue invoices, or engage in profit-making activities directly.

Employment Restrictions: Local employees must be hired through third-party agencies, and there are limitations on the number of foreign representatives.

Tax Requirements: ROs are taxed based on their expenditure and are required to complete annual tax audits.

What is a Joint Venture (JV)?

A Joint Venture (JV) is a limited liability company established through joint investment by Chinese and foreign investors. Both parties collaborate by sharing investment, risks, and profits. In industries subject to government regulation, such as housing construction and automobile manufacturing, JVs are often the only legal form for foreign investment. As an important channel for foreign capital to enter regulated industries in China, JVs come with unique challenges that require careful consideration and preparation from foreign investors.

Joint Venture (JV) Key Limitations

Operational Term: The typical operational term of a JV is no more than 30 years, although it can be extended to 40 years in central and western regions.

Industry Restrictions: Certain sectors only allow foreign investment through the JV model, limiting business options for foreign investors.

Management Structure: JVs must comply with the requirements of Chinese company law, which may impose additional regulatory obligations.

Our Professional Services - One-Stop Solutions

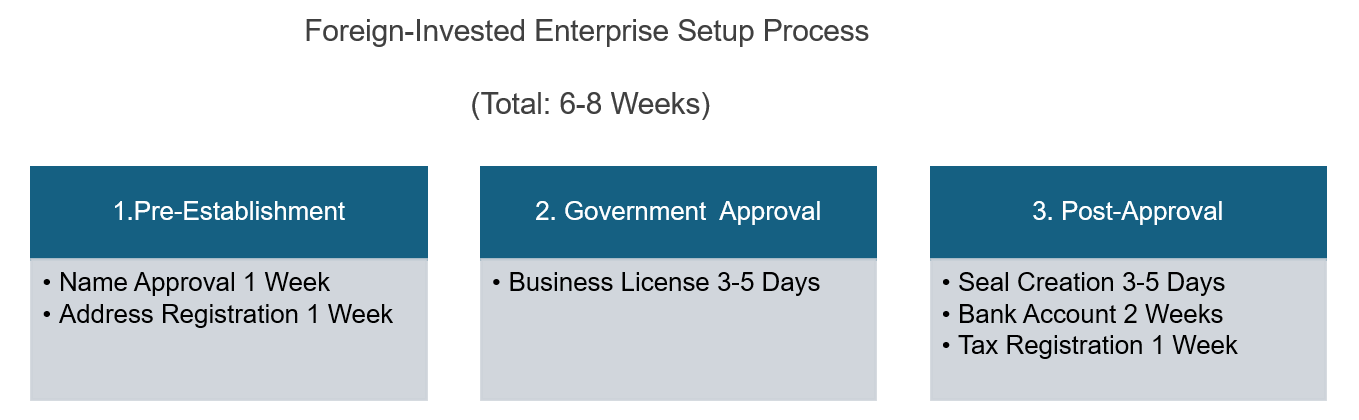

1. Pre-establishment Consultation

Our team provides up-to-date policy advice, conducts comprehensive compliance assessments, analyzes industry access requirements, and designs optimal corporate structures tailored to your business needs.

2. Establishment Services

We handle all aspects of business registration, bank account opening, and tax registration procedures, ensuring a seamless and efficient setup process.

3. Post-establishment Support

Our ongoing services include bookkeeping and tax filing, annual inspection and auditing, as well as visa processing for expatriate employees, allowing you to focus on growing your business.

4. Value-Added Services

We offer specialized services such as tax planning, human resources management, and compliance consulting to help your business thrive in the Chinese market.